FRANKFURT: Allianz AG said its Indonesian unit is launching syariah-compliant insurance products, responding to “growing requests” from its customers and banking partners.

The insurer said customers could now buy life insurance, fire and motor vehicle policies that would be syariah-compliant.

Allianz's share of the Indonesian market is below 3%. The company said it predicted that the booming syariah market would help improve this penetration. Syariah banking in Indonesia grew by 88.6% in 2005. –

Source:

AFX-Asia

Tuesday February 7, 2006

PowerPR alert on Indonesia

Indonesia News

Indonesia Business News

Indonesia Economy

Indonesia Group of Company

Indonesia Finance

Indonesia Banking - News

Indonesia Investment - News

Indonesia Capital Market - News

Indonesia State-Owned Company - News

Indonesia Mining

Indonesia Energy - News

Indonesia Airlines - News

Indonesia Infrastructure - News

Indonesia Shipping and Cargo - News

Indonesia AgriBusiness

Indonesia Entrepreneurship

Indonesia Corporation

Reuters: Business News

Strategic Indonesia

Indonesia Law Enforcement

Indonesia Corruption - News

Indonesia Money Laundering Update

Indonesia Reform Update

Indonesia Religion Issues

Indonesia Security Issues

Indonesia Politics Issues

Indonesia Election 2009 Issues

Indonesia Education Update

Tuesday, February 07, 2006

Telkomsel, Indosat, Excelcom win 3G licenses; PT Telekomunikasi Indonesia and PT Bakrie Telecom failed

The Indonesian government has awarded PT Indonesian Satellite, PT Excelcomindo Pratama and unlisted PT Telekomunikasi Selular, or Telkomsel, licenses to operate third-generation, or 3G networks, State Minister for Information and Communication Sofyan Djalil said on Wednesday.

Third-generation cellular technology offers subscribers high-speed data transmission services such as video streaming, fast downloads, live traffic updates and even home surveillance services.

The tender for the 3G network was attended by fivetelecommunication companies. PT Telekomunikasi Indonesia and PT Bakrie Telecom failed to win the tender.

Based on "the willingness to pay" requirement, Sofyan said both Telkom and Bakrie Telecom failed to meet the requirement."The minimum bid was set at Rp 100 billion (US$10.87 million)," he added.

Indosat offered to pay Rp 160 billion to get the license, while Telkomsel bid Rp 218 billion and Excelcom tendered Rp 188 billion.

The usage of the license is for ten years, Sofyan added.

Indonesia previously granted 3G licenses to cellular phone operator PT Natrindo Telepon Seluler, which is 51 percent owned by Malaysia's biggest cellphone company Maxis Communications Bhd.and PT Cyber Access, 60 percent owned by HutchinsonTelecommunications International Ltd.

However, both Natrindo, which received its 3G license in 2003, and Cyber Access, which obtained a license in 2004, have yet to offer 3G services to their subscribers, as the necessary network infrastructure has still to be put in place.

Analysts said the delay in implementing the 3G network is mostly due to the huge funding required to develop the business.

Source:

Dow Jones

February 08, 2006

Third-generation cellular technology offers subscribers high-speed data transmission services such as video streaming, fast downloads, live traffic updates and even home surveillance services.

The tender for the 3G network was attended by fivetelecommunication companies. PT Telekomunikasi Indonesia and PT Bakrie Telecom failed to win the tender.

Based on "the willingness to pay" requirement, Sofyan said both Telkom and Bakrie Telecom failed to meet the requirement."The minimum bid was set at Rp 100 billion (US$10.87 million)," he added.

Indosat offered to pay Rp 160 billion to get the license, while Telkomsel bid Rp 218 billion and Excelcom tendered Rp 188 billion.

The usage of the license is for ten years, Sofyan added.

Indonesia previously granted 3G licenses to cellular phone operator PT Natrindo Telepon Seluler, which is 51 percent owned by Malaysia's biggest cellphone company Maxis Communications Bhd.and PT Cyber Access, 60 percent owned by HutchinsonTelecommunications International Ltd.

However, both Natrindo, which received its 3G license in 2003, and Cyber Access, which obtained a license in 2004, have yet to offer 3G services to their subscribers, as the necessary network infrastructure has still to be put in place.

Analysts said the delay in implementing the 3G network is mostly due to the huge funding required to develop the business.

Source:

Dow Jones

February 08, 2006

Indonesia invites North Korean leader to Jakarta

JAKARTA (AP): President Susilo Bambang Yodhoyono has invited North Korean leader Kim Jong Il to Jakarta for talks on how to reduce tension with South Korea, presidential spokesman Dino Patti Djalal said on Wednesday.Kim Jong Il, who rarely travels abroad, has said he "welcomed" the offer and also invited Yudhoyono to North Korea, Dino said. He said possible dates for both trips were still being discussed.

The invitation was passed to North Korea by Indonesia's special envoy to the Koreas during a trip to both countries last weekend, he added said.

It was unclear how Kim, who generally shuns planes, would travel to the Indonesian archipelago. During one of his rare trips to Russia, he went by train all the way to Moscow.

The offer is the latest effort by Indonesia to mediate in the dispute.

In January, South Korean Defense Minister Yoon Kwang-ung said during a visit to Jakarta that he would like to meet his North Korean counterpart on the resort island of Bali to discuss ways to reduce tensions between the two countries.

Defense ministers of the two rival Koreas last met in September 2000 on the South Korean resort island of Jeju after first-ever inter-Korean talks in June that year. The two nations remain technically at war because the 1950-1953 Korean War ended in a cease-fire rather than a peace treaty.

Ties have warmed significantly since a meeting of North and South Korean leaders in 2000, but tensions persist over the North's nuclear ambitions.

Indonesia and North Korea have historical ties.The country's first president, Soekarno, was a close friend of North Korean leader Kim Jong Il's late father, Kim Il Sung. Soekarno's daughter, Megawati Soekarnoputri, was Indonesian president between 2001 and 2004 and has kept up a friendship with Kim Jong Il.

Source:

The Jakarta Post

February 08, 2006

The invitation was passed to North Korea by Indonesia's special envoy to the Koreas during a trip to both countries last weekend, he added said.

It was unclear how Kim, who generally shuns planes, would travel to the Indonesian archipelago. During one of his rare trips to Russia, he went by train all the way to Moscow.

The offer is the latest effort by Indonesia to mediate in the dispute.

In January, South Korean Defense Minister Yoon Kwang-ung said during a visit to Jakarta that he would like to meet his North Korean counterpart on the resort island of Bali to discuss ways to reduce tensions between the two countries.

Defense ministers of the two rival Koreas last met in September 2000 on the South Korean resort island of Jeju after first-ever inter-Korean talks in June that year. The two nations remain technically at war because the 1950-1953 Korean War ended in a cease-fire rather than a peace treaty.

Ties have warmed significantly since a meeting of North and South Korean leaders in 2000, but tensions persist over the North's nuclear ambitions.

Indonesia and North Korea have historical ties.The country's first president, Soekarno, was a close friend of North Korean leader Kim Jong Il's late father, Kim Il Sung. Soekarno's daughter, Megawati Soekarnoputri, was Indonesian president between 2001 and 2004 and has kept up a friendship with Kim Jong Il.

Source:

The Jakarta Post

February 08, 2006

Indosat may invest Rp 2 trillion in 3G

JAKARTA: PT Indosat, currently participating in a tender for a 3G frequency license, may invest more than Rp 2 trillion (US$215 million) -- mostly for infrastructure to support the technology -- should it win the tender.

This figure does not form part of the company's capital spending of $670 million in 2006, Indosat president Hasnul Suhaimi said Monday.

The company expects the investment, should it materialize, to begin bringing in returns over the next three years.

Indosat, PT Telkomsel, PT Bakrie Telecom, PT Excelcomindo and PT Telkom are competing for three blocks of 3G frequency licenses that the government is currently offering through a tender -- the winner of which will be announced Feb. 14.

The government has set an initial bid price of Rp 200 billion per block, with each block containing two 5 MHz frequency bands. Indosat has submitted a bid for one block

Source:

The Jakarta Post

February 07, 2006

This figure does not form part of the company's capital spending of $670 million in 2006, Indosat president Hasnul Suhaimi said Monday.

The company expects the investment, should it materialize, to begin bringing in returns over the next three years.

Indosat, PT Telkomsel, PT Bakrie Telecom, PT Excelcomindo and PT Telkom are competing for three blocks of 3G frequency licenses that the government is currently offering through a tender -- the winner of which will be announced Feb. 14.

The government has set an initial bid price of Rp 200 billion per block, with each block containing two 5 MHz frequency bands. Indosat has submitted a bid for one block

Source:

The Jakarta Post

February 07, 2006

Indonesia seeks US$2.5b in loans from CGI to over budget deficit

Despite recent calls to reduce the country's reliance on foreign debt, the government is still hoping to secure at least US$2.5 billion in loans from creditors in the Consultative Group on Indonesia to help cover this year's budget deficit.

The loans, said Finance Minister Sri Mulyani Indrawati during a hearing Monday with the House of Representatives' finance commission, would form part of a total of $3.55 billion in external loans that the government was eying for this year.

"We are expected $1 billion in program loans from the World Bank, the Asian Development Bank and Japan this year. There will also be project loans totaling $2.55 billion, with $1.53 billion of these coming from the CGI," she said.

Other project loans include $915 million from non-CGI lenders, mostly in the form of export credits, and $100 million in undisbursed pledges made in connection with last year's Aceh tsunami disaster.

Japan, the World Bank and the ADB are the three largest creditors grouped in the CGI, which is scheduled to hold its annual meeting sometime in March. The group pledged $3.4 billion in loans and grants last year, besides $1.7 billion in grants and interest-free loans for Aceh.

While the government plans to raise Rp 35.1 trillion (some $3.5 billion) from external sources to help finance this year's budget deficit, projected at Rp 22.4 trillion, or 0.7 percent of gross domestic product, it also plans to raise Rp 50.9 trillion from domestic sources, including through privatizations and bond sales. However, of the total borrowings, up to Rp 63.5 trillion will go toward paying installments on existing debts.

Sri Mulyani said Indonesia's total outstanding foreign debt as of last year amounted to $61.04 billion, but pointed out that the country's debt-to-GDP ratio had declined to 22.7 percent from 42.2 percent in 2000.

Most of the debts are in the form of bilateral loans and are denominated in Japanese yen, which entails certain risks. On the other hand, the interest rates on the loans are more stable.

"The government will maintain prudent debt management, borrowing only when needed at the lowest possible rate and for the longest possible term, and when the projects are ready to proceed," she said.

"We will also carefully guard the exchange rate between the rupiah and the yen, as well as against the dollar, to reduce potential risks vis-a-vis our debts."

Source:

Urip Hudiono, The Jakarta Post, Jakarta

February 07, 2006

The loans, said Finance Minister Sri Mulyani Indrawati during a hearing Monday with the House of Representatives' finance commission, would form part of a total of $3.55 billion in external loans that the government was eying for this year.

"We are expected $1 billion in program loans from the World Bank, the Asian Development Bank and Japan this year. There will also be project loans totaling $2.55 billion, with $1.53 billion of these coming from the CGI," she said.

Other project loans include $915 million from non-CGI lenders, mostly in the form of export credits, and $100 million in undisbursed pledges made in connection with last year's Aceh tsunami disaster.

Japan, the World Bank and the ADB are the three largest creditors grouped in the CGI, which is scheduled to hold its annual meeting sometime in March. The group pledged $3.4 billion in loans and grants last year, besides $1.7 billion in grants and interest-free loans for Aceh.

While the government plans to raise Rp 35.1 trillion (some $3.5 billion) from external sources to help finance this year's budget deficit, projected at Rp 22.4 trillion, or 0.7 percent of gross domestic product, it also plans to raise Rp 50.9 trillion from domestic sources, including through privatizations and bond sales. However, of the total borrowings, up to Rp 63.5 trillion will go toward paying installments on existing debts.

Sri Mulyani said Indonesia's total outstanding foreign debt as of last year amounted to $61.04 billion, but pointed out that the country's debt-to-GDP ratio had declined to 22.7 percent from 42.2 percent in 2000.

Most of the debts are in the form of bilateral loans and are denominated in Japanese yen, which entails certain risks. On the other hand, the interest rates on the loans are more stable.

"The government will maintain prudent debt management, borrowing only when needed at the lowest possible rate and for the longest possible term, and when the projects are ready to proceed," she said.

"We will also carefully guard the exchange rate between the rupiah and the yen, as well as against the dollar, to reduce potential risks vis-a-vis our debts."

Source:

Urip Hudiono, The Jakarta Post, Jakarta

February 07, 2006

Trade figures reveal problems faced by local exporters

Despite record 2005 export earnings, a closer look at the trade statistics suggests the country's manufacturers are having a tough time competing overseas, particularly against more efficient manufacturers from other countries in the region.

The Central Statistics Agency (BPS) reported last week that the country's export earnings jumped by 19.53 percent from the 2004 figure to a record US$85.6 billion.

But according to a more detailed BPS report obtained by The Jakarta Post on Monday, volume-wise, exports only grew by 10.09 percent last year.

Dantes Simbolon, the head of the BPS export statistics subdirectorate, explained that soaring global commodity prices had contributed greatly to the at-first-sight impressive performance.

By volume, oil and gas exports were down 8.6 percent, while non-oil and gas exports, including minerals but excluding coal and sand, increased by 13.1 percent, the BPS figures show.

What is worrying is that in the manufacturing sector, exports of textiles and garments, furniture and electronics have dropped in volume terms. These sectors are among the largest contributors to export revenue and job creation.

Textile and garment exports, for example, only amounted to 1.03 million tons as of October 2005, while exports of these goods reached 1.63 million tons the previous year.

The last two months of 2005 would not have added much to the figures as the year-end is always slower for export-oriented businesses.

Left struggling by China's booming textile and garment industry, Indonesian exports of these products failed to achieve the targeted figure of $7.9 billion, and grew by less than 5 percent last year.

The industry has been plagued by overlapping problems of increasing energy costs, smuggling and aging machinery.

The Indonesian Textile Association reported that 77 export-oriented firms had ceased operating because of increasing energy costs and eroding markets due to a slump in competitiveness.

Meanwhile, exports of wood products and furniture dropped to 3.2 million tons last year as compared to 5.3 million tons in 2004.

The Indonesian Furniture Producers Association placed the blame for the decline on a lack of raw materials and soaring prices for teak -- which is heavily used in the production of furniture destined for export.

Meanwhile, producers of electronic goods complain of the high import duties imposed on components, leading to a lack of price competitiveness on the export market.

This led to a decline in electronics exports to 0.5 million tons last year compared to 0.67 million tons in 2004.

Indonesian Chamber of Commerce and Industry vice chairman Rachmat Gobel said the government needed to further lower the import duties on raw materials for the electronics sector in order to restore competitiveness.

Given the myriad of complaints from the private sector, observers say it is clear the government needs to be more alert in responding to changes in the global market if it wants Indonesia to maintain its place among the ranks of the emerging economies.

Source:

The Jakarta Post, Jakarta

February 07, 2006

The Central Statistics Agency (BPS) reported last week that the country's export earnings jumped by 19.53 percent from the 2004 figure to a record US$85.6 billion.

But according to a more detailed BPS report obtained by The Jakarta Post on Monday, volume-wise, exports only grew by 10.09 percent last year.

Dantes Simbolon, the head of the BPS export statistics subdirectorate, explained that soaring global commodity prices had contributed greatly to the at-first-sight impressive performance.

By volume, oil and gas exports were down 8.6 percent, while non-oil and gas exports, including minerals but excluding coal and sand, increased by 13.1 percent, the BPS figures show.

What is worrying is that in the manufacturing sector, exports of textiles and garments, furniture and electronics have dropped in volume terms. These sectors are among the largest contributors to export revenue and job creation.

Textile and garment exports, for example, only amounted to 1.03 million tons as of October 2005, while exports of these goods reached 1.63 million tons the previous year.

The last two months of 2005 would not have added much to the figures as the year-end is always slower for export-oriented businesses.

Left struggling by China's booming textile and garment industry, Indonesian exports of these products failed to achieve the targeted figure of $7.9 billion, and grew by less than 5 percent last year.

The industry has been plagued by overlapping problems of increasing energy costs, smuggling and aging machinery.

The Indonesian Textile Association reported that 77 export-oriented firms had ceased operating because of increasing energy costs and eroding markets due to a slump in competitiveness.

Meanwhile, exports of wood products and furniture dropped to 3.2 million tons last year as compared to 5.3 million tons in 2004.

The Indonesian Furniture Producers Association placed the blame for the decline on a lack of raw materials and soaring prices for teak -- which is heavily used in the production of furniture destined for export.

Meanwhile, producers of electronic goods complain of the high import duties imposed on components, leading to a lack of price competitiveness on the export market.

This led to a decline in electronics exports to 0.5 million tons last year compared to 0.67 million tons in 2004.

Indonesian Chamber of Commerce and Industry vice chairman Rachmat Gobel said the government needed to further lower the import duties on raw materials for the electronics sector in order to restore competitiveness.

Given the myriad of complaints from the private sector, observers say it is clear the government needs to be more alert in responding to changes in the global market if it wants Indonesia to maintain its place among the ranks of the emerging economies.

Source:

The Jakarta Post, Jakarta

February 07, 2006

Cooperative BLBI bankers may be exempt from trial

The government may revert to the controversial release and discharge policy in the settlement of obligations of delinquent bankers from the Bank Indonesia Liquidity Support (BLBI) program.

The government will screen BLBI debtors to select ones who should be exempt from prosecution, with priority given to those who have been diligent in returning state assets although they fled the country before their cases were processed.

The issue was discussed Monday between President Susilo Bambang Yudhoyono and Attorney General Abdulrahman Saleh, National Police chief Gen. Sutanto, Coordinating Minister for the Economy Boediono, Finance Minister Sri Mulyani Indrawati, chief of the interdepartmental team for corruption eradication Hendarman Supandji, Corruption Eradication Commission chief Taufiequrrahman Ruki and Justice and Human Rights Minister Hamid Awaluddin.

Under the release and discharge policy, which was criticized by non-governmental organizations and corruption watchdogs, ex-bank owners deemed cooperative in settling their debts had all criminal charges dropped against them.

Finance Minister Sri Mulyani said the mechanism was still under discussion because there were no means currently available to manage returned assets from troubled bankers following the disbandment of the Indonesian Banking Restructuring Agency (IBRA).

She said the government was looking into ways to process the debtors, while maximizing resources for the return of state assets, with the main involvement of financial and legal ministries.

"The coordinating minister for the economy will coordinate this," she said.

Four of the bankers came to the presidential office with National Police deputy chief of investigators Insp. Gen. Gorries Mere and National Police director for economic crime Sr. Comr. Benny Mamoto.

National Police chief Gen. Sutanto identified only two of them as Bursa and James. One of them, according to a presidential office staff source who spoke on the condition of anonymity, was Lukman Hastanto, the son in law of debtor and commissioner of disbanded Bank Bira, Atang Latif, who was recently brought back to Indonesia from the United States.

"Three of them have obligations to the state of Rp 615 billion (US$66.13 million), Rp 190 billion and Rp 123 billion respectively. We expect more will follow in the coming weeks," Sutanto said.

They did not meet the President, he added, but came on their own initiative to seek ways to settle their obligations to the state. Sutanto said the debtors would be classified in several groups, including those whose banks experienced problems to mismanagement and irregularities, and institutions forced to seek Bank Indonesia support who then incurred problems.

"We will examine their respective cases. We have to be fair to those who are cooperative in settling their obligations," he said. Abdul Rahman Saleh said the government had lists of debtors who were classified as cooperative and noncooperative. He stressed the latter would be prosecuted.

"But of course we will not process again those who have been exempted from debt obligations by previous governments. Don't mix them up with the newer ones, because we cannot process them again as the public wants," he said.

A banker convicted in the BLBI scam -- David Nusa Wijaya of Bank Servitia -- was returned to Indonesia from the United States last month.

Source:

Tony Hotland, The Jakarta Post, Jakarta

February 07, 2006

The government will screen BLBI debtors to select ones who should be exempt from prosecution, with priority given to those who have been diligent in returning state assets although they fled the country before their cases were processed.

The issue was discussed Monday between President Susilo Bambang Yudhoyono and Attorney General Abdulrahman Saleh, National Police chief Gen. Sutanto, Coordinating Minister for the Economy Boediono, Finance Minister Sri Mulyani Indrawati, chief of the interdepartmental team for corruption eradication Hendarman Supandji, Corruption Eradication Commission chief Taufiequrrahman Ruki and Justice and Human Rights Minister Hamid Awaluddin.

Under the release and discharge policy, which was criticized by non-governmental organizations and corruption watchdogs, ex-bank owners deemed cooperative in settling their debts had all criminal charges dropped against them.

Finance Minister Sri Mulyani said the mechanism was still under discussion because there were no means currently available to manage returned assets from troubled bankers following the disbandment of the Indonesian Banking Restructuring Agency (IBRA).

She said the government was looking into ways to process the debtors, while maximizing resources for the return of state assets, with the main involvement of financial and legal ministries.

"The coordinating minister for the economy will coordinate this," she said.

Four of the bankers came to the presidential office with National Police deputy chief of investigators Insp. Gen. Gorries Mere and National Police director for economic crime Sr. Comr. Benny Mamoto.

National Police chief Gen. Sutanto identified only two of them as Bursa and James. One of them, according to a presidential office staff source who spoke on the condition of anonymity, was Lukman Hastanto, the son in law of debtor and commissioner of disbanded Bank Bira, Atang Latif, who was recently brought back to Indonesia from the United States.

"Three of them have obligations to the state of Rp 615 billion (US$66.13 million), Rp 190 billion and Rp 123 billion respectively. We expect more will follow in the coming weeks," Sutanto said.

They did not meet the President, he added, but came on their own initiative to seek ways to settle their obligations to the state. Sutanto said the debtors would be classified in several groups, including those whose banks experienced problems to mismanagement and irregularities, and institutions forced to seek Bank Indonesia support who then incurred problems.

"We will examine their respective cases. We have to be fair to those who are cooperative in settling their obligations," he said. Abdul Rahman Saleh said the government had lists of debtors who were classified as cooperative and noncooperative. He stressed the latter would be prosecuted.

"But of course we will not process again those who have been exempted from debt obligations by previous governments. Don't mix them up with the newer ones, because we cannot process them again as the public wants," he said.

A banker convicted in the BLBI scam -- David Nusa Wijaya of Bank Servitia -- was returned to Indonesia from the United States last month.

Source:

Tony Hotland, The Jakarta Post, Jakarta

February 07, 2006

Standard & Poors: Bank Industry Overview: Indonesia

Source:

Bank Industry Overview: Indonesia

Primary Credit Analyst:

Adrian Chee, Singapore

Publication date: 17-Jan-06, 21:31:31 EST

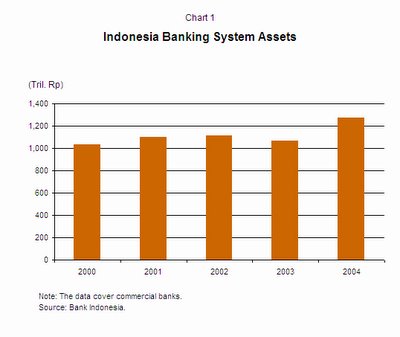

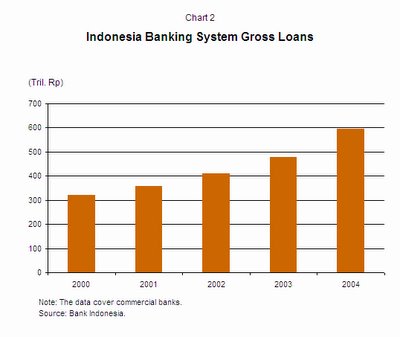

The outlook on the Indonesian banking sector remains stable. The sector has slowly begun to rebuild its financial base since the 1997 economic crisis, and progress has accelerated in the past three years. The level of capitalization in the banking system has risen due to improving investor confidence following several completed privatization programs. The industry risk profile, nevertheless, remains high by international standards because of the high-risk operating environment, characterized by slow corporate debt restructuring, volatile exchange rates, and the need for reforms in the legal system. These factors are partially mitigated by improved political stability, a relatively more stable credit quality and earnings performance, and strengthening capitalization levels. Going forward, the Indonesian banks are expected to experience increasing pressure on their interest margins, from higher deposit costs, as well as in their quality of loan portfolio, in the current rising interest rate environment.

Positive factors

Infusion of best practices and expertise in management strategies, risk management practices, human resources, and IT systems, as a result of foreign institutional investment in major private commercial banks in Indonesia.

Structural improvement where consolidation has reduced the number of banks to around 130 in July 2005, from 208 in 1998. In addition, banks have sought to improve their operating efficiency.

Improved capitalization. The government's large-scale recapitalization program has improved the capital position of banks, which have also benefited from recovering profitability in the past few years. Nevertheless, the banks' capitalization might face renewed pressure as they restart lending to productive sectors of the economy and seek to bolster the level of provisioning for nonperforming assets (NPAs).

Improving asset quality. The banking system's regulatory gross nonperforming loan (NPL) ratio has steadily improved to 8.5% in July 2005, from 32.8% in December 1999. The trend for NPAs, which include NPLs, foreclosed properties, and some restructured loans, is estimated to improve to 15% of total loans in December 2005, from about 50% in 1999.

Negative factors

The resumption of banks' role as financial intermediaries. While the system's loan growth has been strong over the past two years, the loan to asset ratio is still relatively low, at around 40% in 2004. This was partly attributed to the lack of productive loan opportunities in the real sector, and also reflected the corporate sector's high business risks and the large amount of NPLs due for restructuring. The ratio is expected to increase as banks have continued to post strong growth in their lending portfolios in 2005.

Susceptibility of credit quality in a higher interest-rate environment. While the system has demonstrated an overall improvement after the Asian financial crisis, the sharp growth in loans in the past two to three years could strain loan quality following a time lag for NPLs, particularly as interest costs rise as a result of the rising interest rate environment.

A Brighter Day for Asia's Banks?

From Standard & Poor's Ratings Services

Regional growth seems likely to continue, despite high energy prices, and with improving risk-management standards, prospects appear

The nascent Year of the Fire Dog under the Chinese lunar calendar may just be a favorable one for the Asian banking sector. Favorable environmental and operational factors indicate that the outlook remains bright going into 2006. Nonetheless, bank management teams still need to sink their teeth into outstanding issues to prepare for unexpected shocks and the inevitable future cyclical downturn.

Still-strong (albeit slowing) regional GDP growth, improving asset quality, stable and increasingly diverse earnings, and increased management emphasis on risk controls support the banks' improved credit profiles.

RISK FACTORS.

To a certain degree, Standard & Poor's Ratings Services had factored these improvements and expectations into its upgrade on bank ratings in 2005. Outstanding issues in the banks' environment include inherent volatility of economies in which the banks operate and, in some systems, governance concerns in the commercial, political, and legal arenas. These factors imply that Asian banking systems continue to face moderately low to very high economic and industry risks. Not surprisingly, there are some dark clouds in the distance -- these take the form of weaker U.S. consumer demand, relatively high oil prices, emerging bottlenecks in some parts of China's infrastructure, and the uncertain effects of the spread of avian flu, and more importantly public fear about the disease.

Standard & Poor's outlook for the Asian banking systems for 2006 can be summarized as follows:

STREAMLINED OPERATIONS

Inflationary pressures persist, with oil prices only moderating from record highs, even as more oil bears have emerged. Global liquidity, while still ample, is tightening. Asian central banks are playing catch-up with the U.S. Federal Reserve and the pace of interest-rate hikes could quicken in 2006 ahead of a likely end in U.S. policy tightening in June.

Interest-rate increases are thus expected to affect the housing and asset prices in Asian markets, although a major downturn in most real estate markets appears unlikely. The U.S. housing market could be more severely affected by the higher Federal Reserve rate, moderating consumption and thus exports from Asia.

Corporate restructuring -- partly in response to competition from China -- across Asia has streamlined operations and increased capacity utilization as well as capital expenditures. There are also some signs of diversification away from China by U.S. and European investors. Rising interest rates have had greater impact on consumers (from higher mortgages payment) than on corporate investment plans and credit profiles in Asia due partly to strong corporate earnings. Corporate indebtedness is generally low to modest, except for Philippines and, to an extent, Indonesia.

CAPITAL INFLOWS

A more severe outbreak of Avian flu could reduce global GDP by 1% even if the situation does escalate into a pandemic, according to the World Bank. National health authorities have thus far contained the flu to a very small number of geographic locations.

The most immediate uncertainty is inflation and the use of monetary policy (including exchange-rate adjustments) to maintain price stability. Policy responses will inevitably have an impact on the quality of longer-term growth. Strong credit growth and big capital inflows in some economies can complicate monetary policy management.

Negative real rates, for instance, are still prevalent in some economies. The scenario assumes that adjustments in the financial imbalances between the U.S. and the world in terms of currency and interest rates will be gradual.

FAVORABLE FACTORS

Asian countries have largely recovered from the 1997-98 financial crisis, but are vulnerable to the above-mentioned risks. A close look at the state of Asian banking systems should provide a better assessment of their vulnerability to these risks.

Asset quality indicators have continued to improve over the past few years due to write-offs/provisions, recovery from the stock of NPAs—by way of actual recovery or sale to an asset reconstruction/management company—and better quality of incremental credit. Improved economic conditions have been an important supportive factor.

Loan loss reserves are improving. The average loan loss reserves to NPA ratio is above 40% in most Asian banking systems, except China and Taiwan. Loan loss reserves have improved only for a few banking systems, as most banks have used existing provisions to write off the loans.

ONGOING TREND

A few systems still have significant vulnerability in their credit portfolios. Of these, a few like China and Indonesia have seen their credit portfolios grow rapidly. While the growth will spread the risk and provide earning streams to help tackle past delinquencies, it will put pressure on still-evolving risk-containment systems.

In this context, corporate sector credit quality and consumer indebtedness are key risks. India and China are reasonably comfortable on this count, but the Philippines and, to an extent, Indonesia are not. Hence, continued credit growth can help accelerate the trend of improving asset quality for the Chinese, Indian and, perhaps, Indonesian banking systems. The expected slower pace of growth in 2006 would retard the improvement but is unlikely to reverse the trend.

In conclusion, asset quality indicators have vastly improved from four to five years ago. As the low-hanging fruits in the NPA pools have already been plucked, further reduction in NPA would come from resolution of the relatively more hard-core NPAs. Given structural constraints in and challenges faced by the developing economies during the growth phase, the indicators for most Asian banking systems are unlikely to match those of developed systems over the medium term. Standard & Poor's expects asset quality indicators to continue to improve for all Asian systems in 2006 but at a pace slower than in 2005.

Earnings: Stable, More Diversified

The profitability of the Asian banks, as measured by net interest income to average adjusted assets, has largely remained stable in the 2%-3% range, even through the rising interest-rate regime in 2004 and 2005.

PRESSURE ON MARGINS.

Most of the Indonesian banks rated by Standard & Poor's had higher interest margins, exceeding 5%, in 2004 due to a higher level of intermediation. Competitive forces and steeply rising policy rates in Indonesia are expected to cause the interest margin to decline to a more sustainable 3%-4% range.

Variable-rate loans form the lion's share of Asian banks' portfolio. Due to the dominance of shorter-tenure fixed-rate deposits, these liabilities are akin to variable-rate liabilities. Hence, a bank's pricing power determines the impact of rising interest rates, rather than the structure of the balance sheet per se. Except for Singapore and Hong Kong whose markets are dominated by a few big banks, most of the region's banks will experience interest-margin pressure.

To maintain profitability, banks in these competitive markets will target consumer and small to midsize business lending, fee income, and improvement in efficiency and economies of scale. Diversification of the earnings profile, including the focus on noninterest income, has continued. The outlook for growth of noninterest income is bright due to the low penetration of insurance, mutual funds and retail credit businesses, and continued recovery in most economies.

ABOVE-AVERAGE RETURNS

Banks have continued to grow their nonbanking businesses organically as well as inorganically in domestic and overseas markets in a bid to diversify their income. This process is especially visible in Indonesia and Malaysia. Some banks have, however, chosen to tie up with finance companies with good retail franchises.

Although Singapore and Hong Kong banks' interest margins are significantly lower than the 3% rate of most Asian banks, their return on average assets is better at well above 1%. This is due to a higher proportion of noninterest income, better operating efficiency, and low credit costs.

In 2006, we expect the profitability of Asian banking systems to be largely sustained at current levels. The structural improvement in the income profile due to a significant consumer loan book and increasing share of noninterest income should help these systems weather a slight economic slowdown.

Risk Management: Center Stage

The risk-management systems of Asian banks are in various stages of evolution. The Singapore and Hong Kong banks are the most sophisticated, given the developed markets they operate in. After recovering from severe credit losses during the Asian financial crisis, banks are strengthening their risk-management systems.

With the proportion of mandated lending significantly reduced, banks need to develop the capability to originate healthy loans and monitor their portfolios. Gradual improvement in prudential lending norms in line with international standards and the impending implementation of Basel II capital adequacy framework add to the urgency of establishing sound risk-management systems. While this trend is common across all emerging markets, Taiwanese, Malaysian, Indian, and Thai banks are moving further ahead than their regional peers.

In general, the risk-management systems have come a long way. While there is scope for further strengthening, existing systems should partly shield leading banks from the adverse effects of an expected economic slowdown in 2006. We also expect banks to step up the pace in strengthening their risk-management practices.

Consolidation Continues

Another trend is industry consolidation, which has been led or enabled by governments. The speed and effectiveness of consolidation have been mixed, reflecting each country's resolve in achieving its goals.

A less-fragmented banking system tends to be more robust and easier to supervise. Through consolidation, banks are able improve their competitiveness by exploiting synergies and achieving economies of scale. In general, the long-term aim is to have fewer but stronger national banks. While market pressure can also drive consolidation, most emerging Asian banking systems are dominated by government-owned banks and hence market forces alone are insufficient to spur change.

PICKING UP STEAM

While Malaysia saw a rapid and decisive first phase of consolidation and has embarked on the next phase, Taiwan, India, and Thailand still have a long way to go in this direction -- and the clock is ticking. By 2009, their banking systems will open up to foreign banks. Through mergers, domestic banks in fragmented markets like Taiwan, India, and Thailand can take advantage of synergies and economies of scale and thus become better prepared to compete in a liberalized banking environment. Only healthy and efficient domestic banks that have strong business and financial profiles will be ready to meet the competition from established global players.

In 2005, M&A activity was relatively subdued, with transactions mostly involving the acquisition of strategic stakes, rather than majority control. Even though there is little debate on the need for speedy consolidation, the pace of M&A activity in 2006 will be driven by respective governments. In our opinion, bank M&A will gather some steam in 2006 but remain slow as there is no serious visible push from governments as yet.

Source:

BusinessWeek & Standard & Poor's Ratings Services

February, 2006

Regional growth seems likely to continue, despite high energy prices, and with improving risk-management standards, prospects appear

The nascent Year of the Fire Dog under the Chinese lunar calendar may just be a favorable one for the Asian banking sector. Favorable environmental and operational factors indicate that the outlook remains bright going into 2006. Nonetheless, bank management teams still need to sink their teeth into outstanding issues to prepare for unexpected shocks and the inevitable future cyclical downturn.

Still-strong (albeit slowing) regional GDP growth, improving asset quality, stable and increasingly diverse earnings, and increased management emphasis on risk controls support the banks' improved credit profiles.

RISK FACTORS.

To a certain degree, Standard & Poor's Ratings Services had factored these improvements and expectations into its upgrade on bank ratings in 2005. Outstanding issues in the banks' environment include inherent volatility of economies in which the banks operate and, in some systems, governance concerns in the commercial, political, and legal arenas. These factors imply that Asian banking systems continue to face moderately low to very high economic and industry risks. Not surprisingly, there are some dark clouds in the distance -- these take the form of weaker U.S. consumer demand, relatively high oil prices, emerging bottlenecks in some parts of China's infrastructure, and the uncertain effects of the spread of avian flu, and more importantly public fear about the disease.

Standard & Poor's outlook for the Asian banking systems for 2006 can be summarized as follows:

- Asset-quality indicators will continue to improve for all Asian systems in 2006, but at a pace slower than in 2005. The low-hanging fruits in the nonperforming asset (NPA) pools have been plucked and further reduction in NPA would come from resolution of the relatively more hard-core NPAs.

- Profitability of Asian banking systems will be sustained largely at current levels, supported by structural improvement in the income profile.

- The strengthening of risk-management practices at Asian banks will pick up in pace.

- Merger and acquisition (M&A) activity will gather some steam in 2006 but remain slow as there is no serious visible push from governments as yet.

- GDP growth for many Asian economies is likely to remain strong in 2006, despite a slight easing from 2005. In the medium term, a slowing trend is expected. Global macroeconomic conditions, including growth, liquidity, and interest rates, are still favorable for the region's economies.

STREAMLINED OPERATIONS

Inflationary pressures persist, with oil prices only moderating from record highs, even as more oil bears have emerged. Global liquidity, while still ample, is tightening. Asian central banks are playing catch-up with the U.S. Federal Reserve and the pace of interest-rate hikes could quicken in 2006 ahead of a likely end in U.S. policy tightening in June.

Interest-rate increases are thus expected to affect the housing and asset prices in Asian markets, although a major downturn in most real estate markets appears unlikely. The U.S. housing market could be more severely affected by the higher Federal Reserve rate, moderating consumption and thus exports from Asia.

Corporate restructuring -- partly in response to competition from China -- across Asia has streamlined operations and increased capacity utilization as well as capital expenditures. There are also some signs of diversification away from China by U.S. and European investors. Rising interest rates have had greater impact on consumers (from higher mortgages payment) than on corporate investment plans and credit profiles in Asia due partly to strong corporate earnings. Corporate indebtedness is generally low to modest, except for Philippines and, to an extent, Indonesia.

CAPITAL INFLOWS

A more severe outbreak of Avian flu could reduce global GDP by 1% even if the situation does escalate into a pandemic, according to the World Bank. National health authorities have thus far contained the flu to a very small number of geographic locations.

The most immediate uncertainty is inflation and the use of monetary policy (including exchange-rate adjustments) to maintain price stability. Policy responses will inevitably have an impact on the quality of longer-term growth. Strong credit growth and big capital inflows in some economies can complicate monetary policy management.

Negative real rates, for instance, are still prevalent in some economies. The scenario assumes that adjustments in the financial imbalances between the U.S. and the world in terms of currency and interest rates will be gradual.

FAVORABLE FACTORS

Asian countries have largely recovered from the 1997-98 financial crisis, but are vulnerable to the above-mentioned risks. A close look at the state of Asian banking systems should provide a better assessment of their vulnerability to these risks.

Asset quality indicators have continued to improve over the past few years due to write-offs/provisions, recovery from the stock of NPAs—by way of actual recovery or sale to an asset reconstruction/management company—and better quality of incremental credit. Improved economic conditions have been an important supportive factor.

Loan loss reserves are improving. The average loan loss reserves to NPA ratio is above 40% in most Asian banking systems, except China and Taiwan. Loan loss reserves have improved only for a few banking systems, as most banks have used existing provisions to write off the loans.

ONGOING TREND

A few systems still have significant vulnerability in their credit portfolios. Of these, a few like China and Indonesia have seen their credit portfolios grow rapidly. While the growth will spread the risk and provide earning streams to help tackle past delinquencies, it will put pressure on still-evolving risk-containment systems.

In this context, corporate sector credit quality and consumer indebtedness are key risks. India and China are reasonably comfortable on this count, but the Philippines and, to an extent, Indonesia are not. Hence, continued credit growth can help accelerate the trend of improving asset quality for the Chinese, Indian and, perhaps, Indonesian banking systems. The expected slower pace of growth in 2006 would retard the improvement but is unlikely to reverse the trend.

In conclusion, asset quality indicators have vastly improved from four to five years ago. As the low-hanging fruits in the NPA pools have already been plucked, further reduction in NPA would come from resolution of the relatively more hard-core NPAs. Given structural constraints in and challenges faced by the developing economies during the growth phase, the indicators for most Asian banking systems are unlikely to match those of developed systems over the medium term. Standard & Poor's expects asset quality indicators to continue to improve for all Asian systems in 2006 but at a pace slower than in 2005.

Earnings: Stable, More Diversified

The profitability of the Asian banks, as measured by net interest income to average adjusted assets, has largely remained stable in the 2%-3% range, even through the rising interest-rate regime in 2004 and 2005.

PRESSURE ON MARGINS.

Most of the Indonesian banks rated by Standard & Poor's had higher interest margins, exceeding 5%, in 2004 due to a higher level of intermediation. Competitive forces and steeply rising policy rates in Indonesia are expected to cause the interest margin to decline to a more sustainable 3%-4% range.

Variable-rate loans form the lion's share of Asian banks' portfolio. Due to the dominance of shorter-tenure fixed-rate deposits, these liabilities are akin to variable-rate liabilities. Hence, a bank's pricing power determines the impact of rising interest rates, rather than the structure of the balance sheet per se. Except for Singapore and Hong Kong whose markets are dominated by a few big banks, most of the region's banks will experience interest-margin pressure.

To maintain profitability, banks in these competitive markets will target consumer and small to midsize business lending, fee income, and improvement in efficiency and economies of scale. Diversification of the earnings profile, including the focus on noninterest income, has continued. The outlook for growth of noninterest income is bright due to the low penetration of insurance, mutual funds and retail credit businesses, and continued recovery in most economies.

ABOVE-AVERAGE RETURNS

Banks have continued to grow their nonbanking businesses organically as well as inorganically in domestic and overseas markets in a bid to diversify their income. This process is especially visible in Indonesia and Malaysia. Some banks have, however, chosen to tie up with finance companies with good retail franchises.

Although Singapore and Hong Kong banks' interest margins are significantly lower than the 3% rate of most Asian banks, their return on average assets is better at well above 1%. This is due to a higher proportion of noninterest income, better operating efficiency, and low credit costs.

In 2006, we expect the profitability of Asian banking systems to be largely sustained at current levels. The structural improvement in the income profile due to a significant consumer loan book and increasing share of noninterest income should help these systems weather a slight economic slowdown.

Risk Management: Center Stage

The risk-management systems of Asian banks are in various stages of evolution. The Singapore and Hong Kong banks are the most sophisticated, given the developed markets they operate in. After recovering from severe credit losses during the Asian financial crisis, banks are strengthening their risk-management systems.

With the proportion of mandated lending significantly reduced, banks need to develop the capability to originate healthy loans and monitor their portfolios. Gradual improvement in prudential lending norms in line with international standards and the impending implementation of Basel II capital adequacy framework add to the urgency of establishing sound risk-management systems. While this trend is common across all emerging markets, Taiwanese, Malaysian, Indian, and Thai banks are moving further ahead than their regional peers.

In general, the risk-management systems have come a long way. While there is scope for further strengthening, existing systems should partly shield leading banks from the adverse effects of an expected economic slowdown in 2006. We also expect banks to step up the pace in strengthening their risk-management practices.

Consolidation Continues

Another trend is industry consolidation, which has been led or enabled by governments. The speed and effectiveness of consolidation have been mixed, reflecting each country's resolve in achieving its goals.

A less-fragmented banking system tends to be more robust and easier to supervise. Through consolidation, banks are able improve their competitiveness by exploiting synergies and achieving economies of scale. In general, the long-term aim is to have fewer but stronger national banks. While market pressure can also drive consolidation, most emerging Asian banking systems are dominated by government-owned banks and hence market forces alone are insufficient to spur change.

PICKING UP STEAM

While Malaysia saw a rapid and decisive first phase of consolidation and has embarked on the next phase, Taiwan, India, and Thailand still have a long way to go in this direction -- and the clock is ticking. By 2009, their banking systems will open up to foreign banks. Through mergers, domestic banks in fragmented markets like Taiwan, India, and Thailand can take advantage of synergies and economies of scale and thus become better prepared to compete in a liberalized banking environment. Only healthy and efficient domestic banks that have strong business and financial profiles will be ready to meet the competition from established global players.

In 2005, M&A activity was relatively subdued, with transactions mostly involving the acquisition of strategic stakes, rather than majority control. Even though there is little debate on the need for speedy consolidation, the pace of M&A activity in 2006 will be driven by respective governments. In our opinion, bank M&A will gather some steam in 2006 but remain slow as there is no serious visible push from governments as yet.

Source:

BusinessWeek & Standard & Poor's Ratings Services

February, 2006

Singaporean Jemaah Islamiyah leader detained under Internal Security Act

Jakarta: Singapore's most-wanted man, Mas Selamat Kastari, accused of plotting to crash a plane into Changi Airport, is back home under detention after his arrest and deportation by Indonesian authorities.

Singapore JI leader Mas Selamat Kastari who led the Singapore chapter of South-east Asia's Jemaah Islamiyah (JI) terrorist network, was handed over to the Singapore authorities last Friday [3 February] by their Indonesian counterparts, it was announced yesterday.

In its statement, Singapore's Home Affairs Ministry said Mas Selamat is currently being held under the Internal Security Act and investigations into his case will now proceed. It noted that he had fled Singapore in December 2001 following the crackdown on the JI network.

"He was among those who had planned retaliation against Singapore for arresting and detaining his fellow JI members. He had planned to hijack a plane and crash it into Changi Airport," it added.

Indonesia's national police deputy spokesman Anton Bachrul Alam in Jakarta said that the 45-year-old Singaporean was escorted back to his home country by Indonesia's elite anti-terror police.

"He violated immigration laws and he is on the Singaporean police's wanted list, and therefore we helped to hand him over," he said. Brig-Gen Anton told The Straits Times that Mas Selamat was arrested in Malang, in East Java, on 20 January, for possessing a false identification card which gave his name as Hendrawan.

The arrest came shortly after he was released from a prison in Pasuruan, about 40km north of Malang, in December last year. When Mas Selamat was first arrested in Bintan in 2003 and found guilty of similar immigration offences, he was charged and sentenced to 18 months' jail.

His return to Singapore last week ended the Republic's four-year wait to get him in its custody. For three of those years, Mas Selamat had spent time in two Indonesian prisons, including the one in Pasuruan.

The Indonesia-born resident of Teck Whye Lane had fled Singapore in December 2001 following the Republic's security sweep which netted a number of his fellow JI members. His audacious plane crash plot was first revealed by then Prime Minister Goh Chok Tong in April 2002.

He was said to have discussed with other key regional JI leaders, such as Hambali, a plan to hit back at the Singapore Government by hijacking an American, British or Singapore aircraft and crashing it into Changi Airport. That plan never materialized and Hambali has been in US custody since 2003.

Mas Selamat's run from the law lasted 14 months until his January 2003 arrest in Bintan by Indonesian authorities.

He was found guilty of several immigration offences and given an 18-month jail sentence which he served in Pekanbaru, the capital of Sumatra's Riau province.

In August 2004, when the term ended, he was sentenced to another 16 months for 'the same offences', BG Anton told The Straits Times, without going into details. He also did not wish to say why Mas Selamat served the added time in Pasuruan.

But, back in August 2004, sources in Pekanbaru's department of justice told The Straits Times the Singaporean's detention would likely be extended because the authorities wanted more time to investigate if he had any possible JI links in the country.

Whether he was brought to East Java to help in JI-related investigations is not clear, but the group's operatives are known to be active in the area.

Indonesian authorities have blamed the JI for a string of attacks including the 2002 bombings on the island of Bali, which killed 202 people.

Source:

BBC Monitoring & The Straits Times, Singapore,

February 06, 2006

Singapore JI leader Mas Selamat Kastari who led the Singapore chapter of South-east Asia's Jemaah Islamiyah (JI) terrorist network, was handed over to the Singapore authorities last Friday [3 February] by their Indonesian counterparts, it was announced yesterday.

In its statement, Singapore's Home Affairs Ministry said Mas Selamat is currently being held under the Internal Security Act and investigations into his case will now proceed. It noted that he had fled Singapore in December 2001 following the crackdown on the JI network.

"He was among those who had planned retaliation against Singapore for arresting and detaining his fellow JI members. He had planned to hijack a plane and crash it into Changi Airport," it added.

Indonesia's national police deputy spokesman Anton Bachrul Alam in Jakarta said that the 45-year-old Singaporean was escorted back to his home country by Indonesia's elite anti-terror police.

"He violated immigration laws and he is on the Singaporean police's wanted list, and therefore we helped to hand him over," he said. Brig-Gen Anton told The Straits Times that Mas Selamat was arrested in Malang, in East Java, on 20 January, for possessing a false identification card which gave his name as Hendrawan.

The arrest came shortly after he was released from a prison in Pasuruan, about 40km north of Malang, in December last year. When Mas Selamat was first arrested in Bintan in 2003 and found guilty of similar immigration offences, he was charged and sentenced to 18 months' jail.

His return to Singapore last week ended the Republic's four-year wait to get him in its custody. For three of those years, Mas Selamat had spent time in two Indonesian prisons, including the one in Pasuruan.

The Indonesia-born resident of Teck Whye Lane had fled Singapore in December 2001 following the Republic's security sweep which netted a number of his fellow JI members. His audacious plane crash plot was first revealed by then Prime Minister Goh Chok Tong in April 2002.

He was said to have discussed with other key regional JI leaders, such as Hambali, a plan to hit back at the Singapore Government by hijacking an American, British or Singapore aircraft and crashing it into Changi Airport. That plan never materialized and Hambali has been in US custody since 2003.

Mas Selamat's run from the law lasted 14 months until his January 2003 arrest in Bintan by Indonesian authorities.

He was found guilty of several immigration offences and given an 18-month jail sentence which he served in Pekanbaru, the capital of Sumatra's Riau province.

In August 2004, when the term ended, he was sentenced to another 16 months for 'the same offences', BG Anton told The Straits Times, without going into details. He also did not wish to say why Mas Selamat served the added time in Pasuruan.

But, back in August 2004, sources in Pekanbaru's department of justice told The Straits Times the Singaporean's detention would likely be extended because the authorities wanted more time to investigate if he had any possible JI links in the country.

Whether he was brought to East Java to help in JI-related investigations is not clear, but the group's operatives are known to be active in the area.

Indonesian authorities have blamed the JI for a string of attacks including the 2002 bombings on the island of Bali, which killed 202 people.

Source:

BBC Monitoring & The Straits Times, Singapore,

February 06, 2006

Khazanah to invest in toll-road projects

KHAZANAH Nasional Bhd, may invest in toll-road projects in Indonesia, Investor Daily reported.

Khazanah officials have started negotiations with a few Indonesian toll-road companies, the newspaper said, citing Rudi Rusli, chairman of PT Eurocapital Peregrine Securities, which has been appointed as Khazanah's adviser for the planned toll-road investments.

Source:

Investor Daily, Jakarta

February 07, 2006

Khazanah officials have started negotiations with a few Indonesian toll-road companies, the newspaper said, citing Rudi Rusli, chairman of PT Eurocapital Peregrine Securities, which has been appointed as Khazanah's adviser for the planned toll-road investments.

Source:

Investor Daily, Jakarta

February 07, 2006

Former Indonesia religious affairs minister sentenced to five years for corruption

JAKARTA, Judges sentenced a former religious affairs minister to five years in jail Tuesday for his involvement in a multimillion dollar corruption scandal linked to the hajj pilgrimage.

The case has underlined the pervasive nature of graft in Indonesia, and is being seen as a test of President Susilo Bambang Yudhoyono's stated campaign to stamp out the rampant stealing of state funds.

Said Agil Husin Al Munawar was found guilty of illegally spending funds entrusted to the religious affairs ministry by Muslims wanting to perform the hajj pilgrimage, said presiding judge Cicut Sutiarso.

The ministry, which has long been regarded as one of the country's most corrupt government agencies, has a near-monopoly in the lucrative business of transporting about 200,000 pilgrims annually to Saudi Arabia for the hajj.

The crimes caused losses of 709 billion rupiah (US$76 million; €63 million), he said.

Judges said Al Munawar, who was religious affairs minister under the former government of President Megawati Sukarnoputri, spent some of the money on hajj pilgrimages for legislators, as well as other unauthorized payments.

"I cannot accept this unfair verdict because I feel I am not guilty," Al Munawar said after the hearing. "I will appeal."

Al Munawar's lawyers have claimed that he was carrying out state policies, and that the president was ultimately responsible. As well as the five-year jail term, judges also fined Al Munawar 200 million rupiah (US$21,450; €17,900), and ordered him to repay the missing money or serve an extra year in jail.

Yudhoyono took office in October 2004 after a campaign dominated by pledges to crack down on graft. The crackdown so far has netted several high-profile suspects, including a former provincial governor, several district heads and regional and national lawmakers.

Source:

The Associated Press

February 07, 2006

The case has underlined the pervasive nature of graft in Indonesia, and is being seen as a test of President Susilo Bambang Yudhoyono's stated campaign to stamp out the rampant stealing of state funds.

Said Agil Husin Al Munawar was found guilty of illegally spending funds entrusted to the religious affairs ministry by Muslims wanting to perform the hajj pilgrimage, said presiding judge Cicut Sutiarso.

The ministry, which has long been regarded as one of the country's most corrupt government agencies, has a near-monopoly in the lucrative business of transporting about 200,000 pilgrims annually to Saudi Arabia for the hajj.

The crimes caused losses of 709 billion rupiah (US$76 million; €63 million), he said.

Judges said Al Munawar, who was religious affairs minister under the former government of President Megawati Sukarnoputri, spent some of the money on hajj pilgrimages for legislators, as well as other unauthorized payments.

"I cannot accept this unfair verdict because I feel I am not guilty," Al Munawar said after the hearing. "I will appeal."

Al Munawar's lawyers have claimed that he was carrying out state policies, and that the president was ultimately responsible. As well as the five-year jail term, judges also fined Al Munawar 200 million rupiah (US$21,450; €17,900), and ordered him to repay the missing money or serve an extra year in jail.

Yudhoyono took office in October 2004 after a campaign dominated by pledges to crack down on graft. The crackdown so far has netted several high-profile suspects, including a former provincial governor, several district heads and regional and national lawmakers.

Source:

The Associated Press

February 07, 2006

Scientists discover dozens of new species in isolated Indonesian jungle

JAKARTA, Indonesia Scientists discovered a "Lost World" in an isolated Indonesian jungle, identifying dozens of new species of frogs, butterflies and plants as well as large mammals hunted to near extinction elsewhere, members of the expedition said Tuesday.

The team also found wildlife that were remarkably unafraid of humans during its rapid survey of the Foja Mountains, an area in eastern Indonesia with more than a million hectares (two million acres) of old growth tropical forest, said Bruce Beehler, a co-leader of the monthlong trip.

Two Long-Beaked Echidnas, a primitive egg-laying mammal, simply allowed scientists to pick them up and bring them back to their camp to be studied, he said.

The December 2005 expedition to Papua province on the western side of New Guinea island was organized by the U.S.-based environmental organization Conservation International and the Indonesian Institute of Sciences.

The World Wild Fund for Nature, which had no ties to the project, said finding previously unknown species in the sprawling nation, renowned for its rich biodiversity, was not unusual.

"There are many species that have not been identified" in Indonesia, said Chairul Saleh, a species officer for the global environmental conservation group.

Papua, the scene of a decades-long separatist rebellion that has left an estimated 100,000 people dead, is one of the country's most remote provinces, geographically and politically, and access by foreigners is tightly restricted.

The 11-member team of U.S., Indonesian and Australian scientists needed six permits before they could legally fly by helicopter to an open, boggy lakebed surrounded by forests near the range's western summit.

"There was not a single trail, no sign of civilization, no sign of even local communities ever having been there," said Beehler, adding that two headmen from the Kwerba and Papasena tribes, the customary landowners of the Foja Mountains, accompanied the expedition.

"They were as astounded as we were at how isolated it was," he told The Associated Press in a telephone interview from Washington D.C. "As far as they knew, neither of their clans had ever been to the area."

The scientists said they discovered 20 frog species _ including a tiny microhylid frog less than 14 millimeters (a half inch) long _ four new butterfly species, and at least five new types of palms.

Their findings, however, will have to be published and then reviewed by peers before being officially classified as new species, a process that could take six months to several years.

Because of the rich diversity in the forest, the group rarely had to stray more than a few kilometers (miles) from their base camp. "We've only scratched the surface," said Beehler, vice president of Conservation International's Melanesia Center for Biodiversity Conservation, who hopes to return later this year with other scientists.

One of the most remarkable discoveries was the Golden-mantled Tree Kangaroo, an arboreal jungle-dweller new for Indonesia and previously thought to have been hunted to near extinction, and a new honeyeater bird, which has a bright orange face-patch with a pendant wattle under each eye, Beehler said.

The scientists also took the first known photographs of Berlepsch's Six-Wired Bird of Paradise, described by hunters in New Guinea in the 19th century.

The scientists said they watched in amazement as, just one day after arriving, a male bird performed a courtship dance for an attending female in their camp, shaking the long feathers on its head. One of the reasons for the rain forest's isolation, Beehler said, was that only a few hundred people live in the region and game in the mountain's foothills is so abundant that they had no reason to venture into the jungle's interior.

There did not appear to be any immediate conservation threat to the area, which has the status of a wildlife sanctuary, he said. "No logging permits are given to this area, there is no transport system _ not a single road," Beehler said.

"But clearly with time everything is a threat. In the next few decades there will be strong demands, especially if you think of the timber needs of nearby countries like China and Japan. They will be very hungry for logs."

Source:

The Associated Press

February 07, 2006

The team also found wildlife that were remarkably unafraid of humans during its rapid survey of the Foja Mountains, an area in eastern Indonesia with more than a million hectares (two million acres) of old growth tropical forest, said Bruce Beehler, a co-leader of the monthlong trip.

Two Long-Beaked Echidnas, a primitive egg-laying mammal, simply allowed scientists to pick them up and bring them back to their camp to be studied, he said.

The December 2005 expedition to Papua province on the western side of New Guinea island was organized by the U.S.-based environmental organization Conservation International and the Indonesian Institute of Sciences.

The World Wild Fund for Nature, which had no ties to the project, said finding previously unknown species in the sprawling nation, renowned for its rich biodiversity, was not unusual.

"There are many species that have not been identified" in Indonesia, said Chairul Saleh, a species officer for the global environmental conservation group.

Papua, the scene of a decades-long separatist rebellion that has left an estimated 100,000 people dead, is one of the country's most remote provinces, geographically and politically, and access by foreigners is tightly restricted.

The 11-member team of U.S., Indonesian and Australian scientists needed six permits before they could legally fly by helicopter to an open, boggy lakebed surrounded by forests near the range's western summit.

"There was not a single trail, no sign of civilization, no sign of even local communities ever having been there," said Beehler, adding that two headmen from the Kwerba and Papasena tribes, the customary landowners of the Foja Mountains, accompanied the expedition.

"They were as astounded as we were at how isolated it was," he told The Associated Press in a telephone interview from Washington D.C. "As far as they knew, neither of their clans had ever been to the area."

The scientists said they discovered 20 frog species _ including a tiny microhylid frog less than 14 millimeters (a half inch) long _ four new butterfly species, and at least five new types of palms.

Their findings, however, will have to be published and then reviewed by peers before being officially classified as new species, a process that could take six months to several years.

Because of the rich diversity in the forest, the group rarely had to stray more than a few kilometers (miles) from their base camp. "We've only scratched the surface," said Beehler, vice president of Conservation International's Melanesia Center for Biodiversity Conservation, who hopes to return later this year with other scientists.

One of the most remarkable discoveries was the Golden-mantled Tree Kangaroo, an arboreal jungle-dweller new for Indonesia and previously thought to have been hunted to near extinction, and a new honeyeater bird, which has a bright orange face-patch with a pendant wattle under each eye, Beehler said.

The scientists also took the first known photographs of Berlepsch's Six-Wired Bird of Paradise, described by hunters in New Guinea in the 19th century.

The scientists said they watched in amazement as, just one day after arriving, a male bird performed a courtship dance for an attending female in their camp, shaking the long feathers on its head. One of the reasons for the rain forest's isolation, Beehler said, was that only a few hundred people live in the region and game in the mountain's foothills is so abundant that they had no reason to venture into the jungle's interior.

There did not appear to be any immediate conservation threat to the area, which has the status of a wildlife sanctuary, he said. "No logging permits are given to this area, there is no transport system _ not a single road," Beehler said.

"But clearly with time everything is a threat. In the next few decades there will be strong demands, especially if you think of the timber needs of nearby countries like China and Japan. They will be very hungry for logs."

Source:

The Associated Press

February 07, 2006

SingTel reports nearly 78 million mobile subscribers in Asia

SINGAPORE, -- Singapore Telecommunications ( SingTel) said Tuesday that its mobile subscriber base in Asia grew by 26 percent last year to reach 77.79 million as of the end of 2005.

"This is the largest mobile customer base in Asia outside of China," said a statement released Tuesday by the company, which is one of the leading telecom services providers in the city state and Asia.

SingTel's five regional mobile associates in Bangladesh, India, Indonesia, the Philippines and Thailand reported a total of 69.87 million subscribers by the end of last year, posting an increase of 29.8 percent over the previous year.

Its Australian subsidiary Optus expanded the user base to 6.3 million as of the end of 2005, up 1.6 percent from a year ago, the statement said, adding that it "was achieved despite intense competition in the Australian mobile market."

At home, the number of SingTel's mobile customers rose by 5.2 percent from 2004 to reach 1.62 million at the end of last year, which included some 55,000 users of the third generation (3G) mobile services.

Source:

Xinhua

February 07, 2006

"This is the largest mobile customer base in Asia outside of China," said a statement released Tuesday by the company, which is one of the leading telecom services providers in the city state and Asia.

SingTel's five regional mobile associates in Bangladesh, India, Indonesia, the Philippines and Thailand reported a total of 69.87 million subscribers by the end of last year, posting an increase of 29.8 percent over the previous year.

Its Australian subsidiary Optus expanded the user base to 6.3 million as of the end of 2005, up 1.6 percent from a year ago, the statement said, adding that it "was achieved despite intense competition in the Australian mobile market."

At home, the number of SingTel's mobile customers rose by 5.2 percent from 2004 to reach 1.62 million at the end of last year, which included some 55,000 users of the third generation (3G) mobile services.

Source:

Xinhua

February 07, 2006

Indonesia to Discuss Garuda Debt Restructuring Plan

The state minister for state firms and officials of the ministry of finance will meet with ambassadors of the countries grouped in the European Credit Agency to discuss restructuring of PT Garuda Indonesia's debts.

"The meeting will be conducted in the second week this month," State Minister for State Firms Sugiharto said here on Friday.

He said he would explain to the creditors the latest condition of the country's flag carrier.

"This reflects the attention of the government as a shareholder in PT Garuda," he said.

The total debts of PT Garuda have reached US$800 million and US$510 million of the amount are debts to the European Credit Agency, while another US$130 million are mid-term debts and the rest are debts to Bank Mandiri and PT Angkasa Pura I and II.

He said the US$55 million mid-term debts were due at the end of 2005, but Garuda failed to pay it.